A Strong Foundation

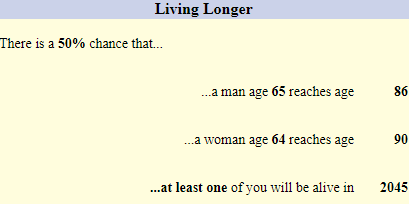

Living longer than ever Retirees your age are living longer than ever. Medical advances, etc. are keeping them healthy and active. Your money needs to last longer, but fortunately, time is also a very valuable asset.

Understand your lifestyle

The first step in a good retirement plan is to take an inventory of your assets, income, and expenses. Understand what you have, which income is reliable and which is risky, and which are your mandatory expenses and which are discretionary.

Balance guarantees with returns

Nothing in life is free. You can have a safe retirement nest egg, or a high-return but risky one. Finding the right balance is the most important step. A safe retirement plan is designed to ensure that you will always have enough income to cover your mandatory expenses.

Make the most of what you have

But hiding your money in a mattress is not the answer. You also need an investment plan that can leverage the fact that people are living longer. A well-balanced, "New Retirement" Portfolio is designed to make your assets produce a higher potential income and last as long as possible.

Plan for the expected unexpected

LTC, Health Care expenses are rising. Don’t get caught off guard. Make sure that your plan incorporates these costs. Disability or premature death could derail your entire plan. We’ll take a look at these risks and seek proper protection.

Source: WealthVision

Tracking #1-464255